Published on: August 19, 2022

Written by Eric Devin / Fact-checked by David Rowan

You might be wondering if you need flood insurance for a second-floor condo. Well, let’s talk about it!

Elevation can play a big role in determining flood risk. Even if your condominium is on the second floor, common areas and lower units might be susceptible to water damage. When these spaces get hit, it could impact you too. Imagine your building’s utilities or structure getting damaged. That’s no fun, right?

Then there’s FEMA. Their floodplain maps help in figuring out if your area is prone to flooding. If your condo is within a high-risk zone, your association might even have a master policy. But here’s the thing – that policy might not cover everything, especially personal belongings inside your unit. Plus, premiums for these master policies often get passed down to residents, affecting monthly dues.

Getting a personal flood insurance policy can fill in those coverage gaps. And hey, better safe than sorry, right? Interested in all the nitty-gritty details? We’ve got you covered. Keep reading the detailed article below!

Do I Need Flood Insurance for a Second Floor Condo?

The Basics of Flood Insurance

You’ve got questions about flood insurance, right? Let’s break it down. Flood insurance is essentially a safety net for your property against water damage. Think of heavy rainfalls or river overflows; that’s when it steps in. And even though it seems straightforward, many folks hold onto some pretty wild misconceptions about it.

What is flood insurance and who needs it?

Picture this: It’s a bright, sunny day, and you’re sipping on your favorite drink. Out of nowhere, clouds gather, and a torrential downpour begins. Your beautiful condo and precious belongings can get caught in Mother Nature’s mood swings. That’s where flood insurance becomes your trusty umbrella. And guess what? It’s not just for folks living beside rivers or on the ground floor.

Common misconceptions about flood insurance

Let’s squash some myths, shall we? Myth 1: “I’m on the second floor, so no floods can touch me.” Think again! What about the common areas or the unit below you? Myth 2: “My regular home insurance has got me covered.” Nope, most of them don’t. Surprising, right?

Assessing Risk Factors for Second Floor Condos

Location, location, location! It’s not just about real estate prices; it’s also about flood risk.

Elevation and its impact on flood risk

High ground might seem like a safe haven, but what if the entire area gets submerged? It might sound dramatic, but it happens. You could be floating on the second floor, but if the ground floor is underwater, there’s a chain of problems awaiting you.

Past flood events and their reach

Remember that big flood a decade ago? What about the minor one just last year? If these events touched even the tip of your condo area, it’s worth giving flood insurance a thought.

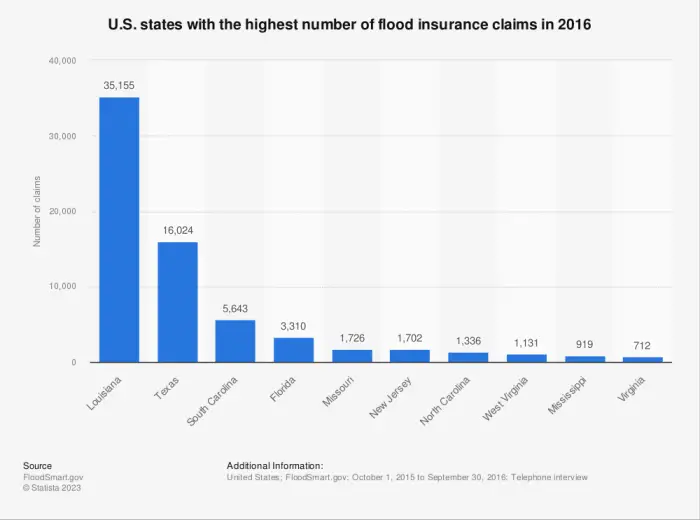

U.S. states with the highest number of flood insurance claims in 2016

FEMA and Its Role

Ah, FEMA! It’s like the big brother of flood scenarios, always watching and mapping.

Introduction to FEMA floodplain maps

So, FEMA’s got this cool tool, floodplain maps. It’s like Google Maps but for flood risks. It pinpoints areas more likely to face floods. Handy, isn’t it?

Determining if your condo is within a high-risk zone

If your condo’s pin on the FEMA map is colored deep blue or red, that’s a heads up! High-risk zones aren’t just marketing jargon. They’re legit alerts.

The Association’s Master Policy

Ever heard of this one? It’s a big deal in the condo world.

What it is and what it covers

The association master policy is like the guardian angel for your entire condo building. It generally shields common areas from damages. But wait, there’s a twist. It may not cover everything.

Common gaps in coverage

Imagine baking a cake and forgetting the icing. Some master policies are just like that – incomplete. They might leave out important facets like personal belongings or internal fixtures.

| Personal Flood Insurance | Master Policies | |

| Coverage | Interior, belongings, appliances | Common areas, external structure |

| Cost | Varies by location & property value | Often shared among residents |

| Gaps | Might not cover external damages | Might not cover personal belongings |

Evaluating the Real Cost

Ah, the million-dollar question: How much will it cost me?

Upfront premiums vs potential loss

You could think of paying for flood insurance like buying a fancy coffee machine. Spend a bit now, but save loads on those daily café trips later. A little upfront can prevent major heartaches (and financial drains) in the future.

Effect of flood history on premiums

Past actions have consequences! If your area’s been a frequent flood guest, expect the insurance rates to reflect that.

Benefits of Flood Insurance for Upper Floor Condos

Still on the fence? Let’s chat about why it might be a good idea.

Protecting your personal belongings

You love your snazzy new TV and grandma’s heirloom vase, right? What if a flood ruins them? Flood insurance helps ensure you can replace or repair them without a huge dent in your pocket.

Peace of mind during unexpected events

Sleeping soundly, knowing you’re protected, has no price tag. No one likes surprises, especially not the watery, destructive kind.

What Happens If I Don’t Get Covered?

It’s your choice, of course, but let’s ponder the consequences.

Real-life examples of uninsured losses

Remember Joe from next door? He didn’t have flood insurance. After last year’s flood, he had to shell out big bucks for repairs. Don’t be like Joe.

The financial aftermath

Saving a few dollars today might lead to spending stacks tomorrow. Weigh the pros and cons before deciding.

| Rank | Damage Type | Average Cost Without Insurance |

| 1. | Basement flooding | $10,000 |

| 2. | Structural damage | $30,000 |

| 3. | Electrical system damage | $5,000 |

| 4. | Appliance damage | $3,000 |

| 5. | Furniture & personal items damage | $8,000 |

Tips to Choose the Right Flood Insurance Policy

Alright, so maybe you’re considering getting insured. Smart move! But how do you pick the right policy?

Coverage amount considerations

Start by playing detective. List down what you own and estimate its value. Would you like coverage just for the big-ticket items or down to your favorite pair of shoes?

Picking a reputable insurance company

It’s a bit like dating. Don’t go for the first one that comes along. Research, read reviews, and maybe even ask your neighbors who they trust.

How Elevation Certificates Influence Insurance Rates

These certificates aren’t just fancy pieces of paper. They can be your golden ticket to lower premiums.

The purpose of elevation certificates

Picture an elevation certificate as a report card for your condo’s altitude. It tells insurers how high above potential floodwaters your place sits.

Acquiring and using an elevation certificate

Grabbing one isn’t a Herculean task. Typically, a local surveyor can whip one up for you. Once you have it, share it with your insurer, and watch those rates potentially take a dip.

| Elevation (feet above sea level) | Average Premium Cost |

| 0-5 | $2,500 |

| 6-10 | $2,000 |

| 11-15 | $1,500 |

| 16+ | $1,000 |

Addressing Other Concerns

Got more questions swirling in your head? Let’s tackle some.

Potential damage to common areas and utilities

Think about the elevators, hallways, and even the shared gym. If they’re out of commission because of a flood, it affects you, right? If the ground floor is swimming, you might find yourself stuck.

The ripple effect of water damage in condos

Water’s sneaky. It gets into nooks and crannies and can wreak havoc, traveling from one unit to another. Being on the second floor doesn’t necessarily mean you’re in the clear.

Addressing the Skeptics: Counterarguments

We get it; there are always two sides to a coin.

Why some skip flood insurance

Some might argue, “It hasn’t flooded in years!” or “The cost isn’t worth it.” Fair points, but what if this year is different?

Counterpoints for every argument

For every reason to skip out on insurance, there’s a compelling reason to consider it. Is the peace of mind worth it? For many, the answer is a resounding yes.

FAQs

What Are the Flood Insurance Requirements for Condos?

There are specific guidelines set by federal, state, and local regulations. Generally, condos located in high-risk zones with a federally backed mortgage are required to have flood insurance.

Why Would a Condo Owner Need Flood Insurance?

While the condo might be on a higher floor, common areas, utilities, or even water seeping upwards can impact their property. Moreover, for peace of mind and protection from unforeseen events, it’s often recommended.

Can Condo Associations Be Required to Have Flood Insurance?

Yes, condo associations, especially those in high-risk flood areas, might be mandated by local or federal regulations to carry flood insurance, covering common areas and the overall building structure.

Does an HOA Typically Cover Flood Insurance?

It varies. Some HOAs might include flood insurance in their coverage, especially if they are in flood-prone zones. However, always review the specifics of the HOA policy to determine what’s covered.

Is There Specific FEMA Guidance on Condo Flood Insurance Requirements?

Yes, FEMA has guidelines for condos. If the condo is in a Special Flood Hazard Area (SFHA) and has a federally backed mortgage, it’s typically required to have flood insurance.

Are There Specific Flood Insurance Requirements for Condos in Florida?

Given its susceptibility to hurricanes and flooding, Florida has stringent flood insurance regulations. Condos, especially in designated flood zones, often need specific coverage amounts based on their risk.

How Does Master Flood Insurance Policy Work for Condos?

A Master Flood Insurance Policy generally covers the building and common areas. Condo owners might still need a separate policy for their individual units and personal belongings, depending on the master policy’s coverage scope.

Alright, let’s wrap this up! Assessing whether you need flood insurance for your second-floor condo isn’t a simple yes or no. It’s about weighing risks, considering your assets, and thinking about the bigger picture. At the end of the day, isn’t it better to be ready and protected than regretful and picking up the pieces?

References:

Additional Resources:

Relevant Resources:

- The Ideal Battery Size for Your 50hp Johnson Outboard

- Building the Ultimate Self-Sustaining Tool Shed: A Step-By-Step Guide

- How Often Should You Paint Your House in Florida?

- Untangling the Complexity of CeDUR Roofing Problems

- Do I Need a Permit to Level My Yard?

- A Comprehensive Guide to Energy Efficiency

About This Writer

Hi, I am Eric Devin and I am a professional interior architect. Since childhood, I've always enjoyed DIY projects! And, I have loved to solve simple household problems using essential tools and equipment. I have also acquired a lot of information about basic household tools settings by working with contractors.